[ad_1]

The Reserve Bank of India’s decision to keep repo rates unchanged at 6.5% for ninth consecutive time aligns well with the August 7 announcement on indexation benefits on sale of property. With interest rates staying steady, EMIs will remain manageable for current and potential homeowners, potentially leading to increased home sales particularly in the price-sensitive affordable segment, said real estate experts.

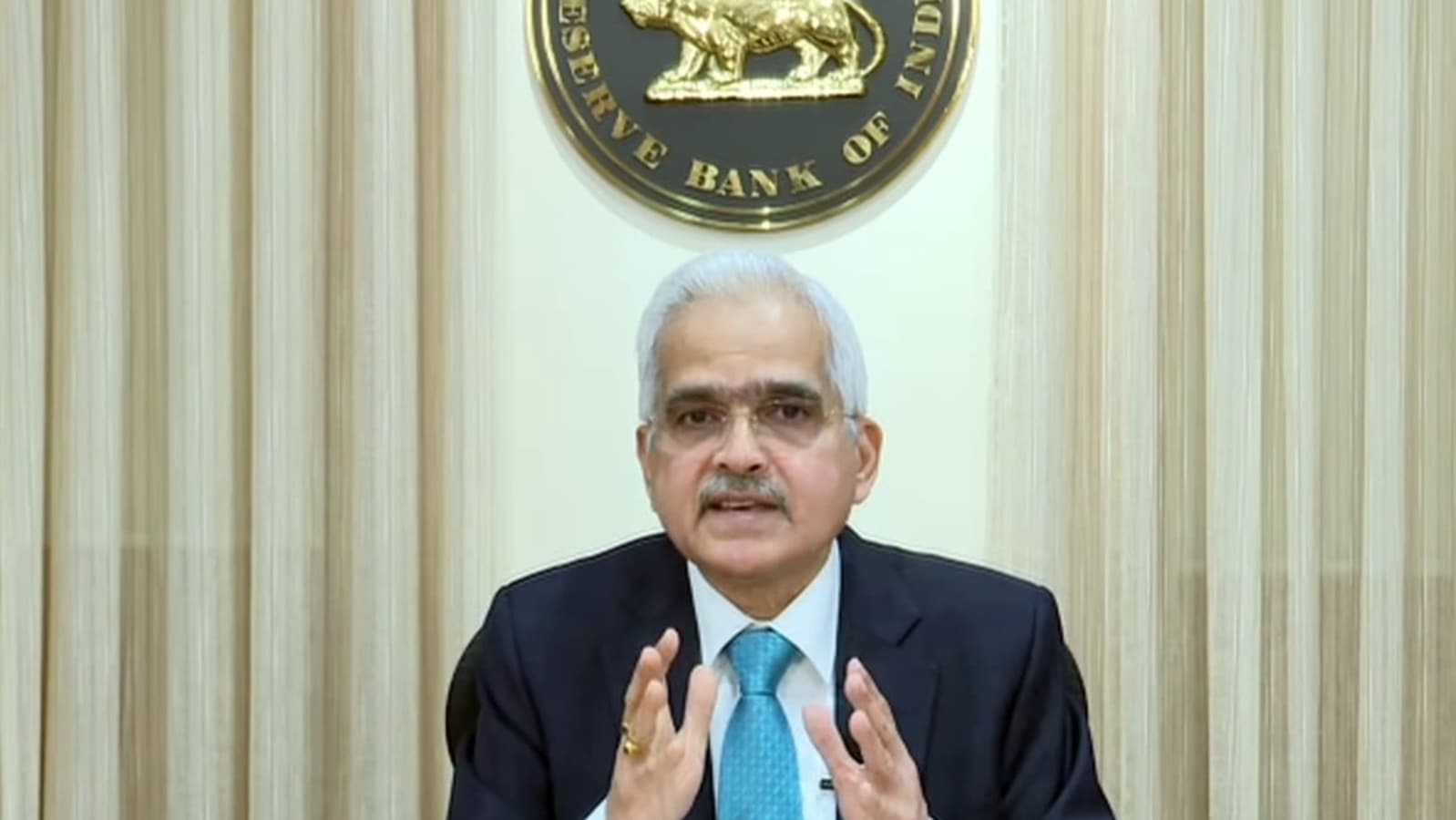

“The monetary policy committee decided by a 4:2 majority to keep the policy repo rate unchanged at 6.5%. Consequently, the standing deposit facility (SDF) rate remains at 6.25%, and the marginal standing facility (MSF) rate and the bank rate at 6.75%,” RBI governor Shaktikanta Das said on August 8.

Also Read: RBI keeps repo rate unchanged at 6.5%; Inflation, GDP growth forecast for FY25 retained

The Reserve Bank of India has decided to keep the policy rate unchanged for the ninth time in a row, saying food inflation remains stubborn.

“Maintaining interest rates offers consistency in borrowing costs, which will prompt more aspiring homebuyers to consider taking the plunge – and thus drive demand in the housing market. With interest rates staying steady, EMIs will remain manageable for current and potential homeowners, potentially leading to increased home sales – particularly in the price-sensitive affordable segment,” said Anuj Puri, chairman, ANAROCK Group.

The announcement regarding indexation on August 7 brings tax advantages for property investors, as it permits adjustments to the purchase price keeping inflation in mind, reducing capital gains tax burdens upon property sale. This provision increases the appeal of real estate investments, which will spur demand and capital flow into the housing sector. These combined actions bolster investor trust and position real estate as an avenue for long-term wealth growth, he said.

The RBI’s intention in keeping rates unchanged is to ensure a stable interest rate environment and price stability in order to achieve sustained growth, said Samantak Das, Chief Economist and head of Research and REIS, India, JLL.

“Nevertheless, future rate cuts in India will primarily be influenced by domestic factors. With food inflation still exhibiting sporadic behaviour, the RBI remains committed to sustaining inflation alignment with their targets on a durable basis. This commitment sets the stage for potential rate cuts in the final quarter of 2024 or early 2025, as the last phase of disinflation unfolds,” he said.

Sentiment likely to sustain over the upcoming festive season

He said that with the sentiment likely to sustain and further strengthen over the upcoming festive season, the current status quo on the repo rate would further support this momentum in 2025.

Stability in interest rates coupled with the recent announcement to rationalize stamp duty charges along with concessions for women homebuyers bodes well for the real estate sector, especially the residential segment.

“Strong visibility in financing charges should help homebuyers and developers alike in the upcoming festive season. Moreover, partial withdrawal of the applicability of the revised LTCG tax arising out of sale of land and buildings retrospectively provides elbow room to affect housing sales with minimal tax outgo. This is likely to buoy investors and homeowners’ sentiment and thus the real estate sector at large throughout 2024,” said Vimal Nadar, senior director and head, Research at Colliers India.

Also Read: Big relief for homeowners as government gives options on long term capital gains tax

The Central Bank also emphasized on building a robust banking credit system embedded with stringent credit appraisal processes and risk management systems for retail loans especially top-up and gold loans. As top up and gold loans pose significant risk, the Bank has urged to strengthen the credit appraisal and disbursement process relating to security, purpose of the loan, said Nadar.

Real estate developers welcome RBI’s decision

G Hari Babu, National President of NAREDCO said that the RBI’s decision to keep the repo rate at 6.5% and maintain the GDP growth forecast at 7.2% for FY25 creates a stable environment for the real estate sector.

“With steady borrowing costs, home loans become more affordable, which is likely to boost demand in the housing market, especially during the upcoming festive season. This stability allows developers to plan projects confidently, knowing that financing conditions will remain favorable. The RBI’s balanced approach to economic management helps maintain market confidence, reassuring investors amidst global economic uncertainties,” he said.

Also Read: RBI Monetary Policy 2024: Stability in interest rates to benefit homebuyers; boost housing sales

Aman Sarin, director and chief executive officer, Anant Raj Limited, welcomed the RBI’s decision and said that the stable interest rates are particularly beneficial for the real estate sector. “When interest rates remain steady, home buyers can plan their purchases without the uncertainty of potential rate hikes. The cost of borrowings too remain stable, thus, stable cost of construction,” he said.

“The RBI’s decision to keep rates unchanged is on expected lines with an intention to keep inflation under check. While the RBI is focused on reining in inflation within its target limit, the expectation of good monsoon may prompt the apex bank to lower interest rates in the subsequent months thereby further propelling real estate sales momentum and also providing an opportunity to prospective homebuyers to enter in the market. While portraying a robust forecast for economic growth, the RBI’s all-round efforts will positively impact homebuyers sentiments and industry as well,” said Pradeep Aggarwal, founder and chairman, Signature Global (India) Ltd.

[ad_2]

Source link

Join The Discussion