[ad_1]

In a major relief to property owners, the government on August 7 amended the long term capital gains tax provision on immovable properties giving homeowners the option to choose between a lower tax rate of 12.5% without indexation or a higher rate of 20% with indexation for properties acquired before July 23, 2024.

This will allow taxpayers to compute taxes under both schemes and provide them a choice to pay tax under the scheme in which it is lower.

Tax experts point out that homeowners should remember that the choice between the indexed and non-indexed tax regimes depends on the sale price. They should be aware that where the growth in the value of property is faster, a LTCG tax of 12.5% without indexation may be more beneficial and where it is slow, the second option may be better. Indexation benefit may be better for properties that have been held for a longer duration and have witnessed a higher inflation rate.

Finance Minister Nirmala Sitharaman had in Budget 2024-25 proposed to lower the long-term capital gains tax on real estate to 12.5% from 20% but without the indexation benefit. The government decided to amend the LTCG tax provision for real estate after the new provision was criticized for raising tax incidence and disincentivizing investments in the real estate sector.

Also Read: Big relief for homeowners as government gives options on long term capital gains tax

Indexation benefit allows taxpayers to arrive at the cost price of the property after adjusting for inflation.

Shishir Baijal, Chairman and Managing Director, Knight Frank India is of the view that while the 12.5% rate may seem immediately attractive, the decision to opt for it or the 20% rate with indexation should be made after careful consideration of individual circumstances.

Ideally, if a property’s value has significantly outpaced inflation, the 12.5% rate might be more beneficial. However, indexation could be advantageous in cases where property appreciation is closer to the inflation rate. This amendment is expected to stimulate investment and sales in the housing market by potentially reducing the tax burden on sellers, he added.

1 How should homeowners choose which tax rate is better for them?

According to Gaurav Karnik, partner and real estate national leader, EY India, homeowners should choose the tax rate that results in the lowest tax liability when selling their property. To decide which rate is better, they should:

Calculate the taxable gain without indexation by deducting the original purchase price from the sale price.

Calculate the taxable gain with indexation by deducting the indexed purchase cost, adjusted for inflation using the Cost Inflation Index (CII), from the sale price.

Apply the respective tax rates to the calculated gains: 12.5% without indexation and 20% with indexation.

Compare the two tax liabilities and opt for the tax rate that yields the lower tax liability.

Additionally, the duration for which the property has been held is a crucial factor while choosing between both the tax regime.

For Short-Term Holdings: The benefit of indexation may not be significant enough to outweigh the higher tax rate. In such cases, the non-indexed rate of 12.5% might be more beneficial.

Long-Term Holdings: Indexation can considerably increase the cost basis, which can lead to a lower tax liability even with the higher tax rate of 20%. This makes the indexed rate potentially more favorable for long-term holdings, he said.

2. If a property is bought in 2020 and sold in 2024 – what will be the tax liability and which regime should the homeowner opt for?

To ascertain the most advantageous tax regime when selling a property, homeowners should compute the tax liabilities under both the non-indexed and indexed options and select the one that minimizes their tax outlay.

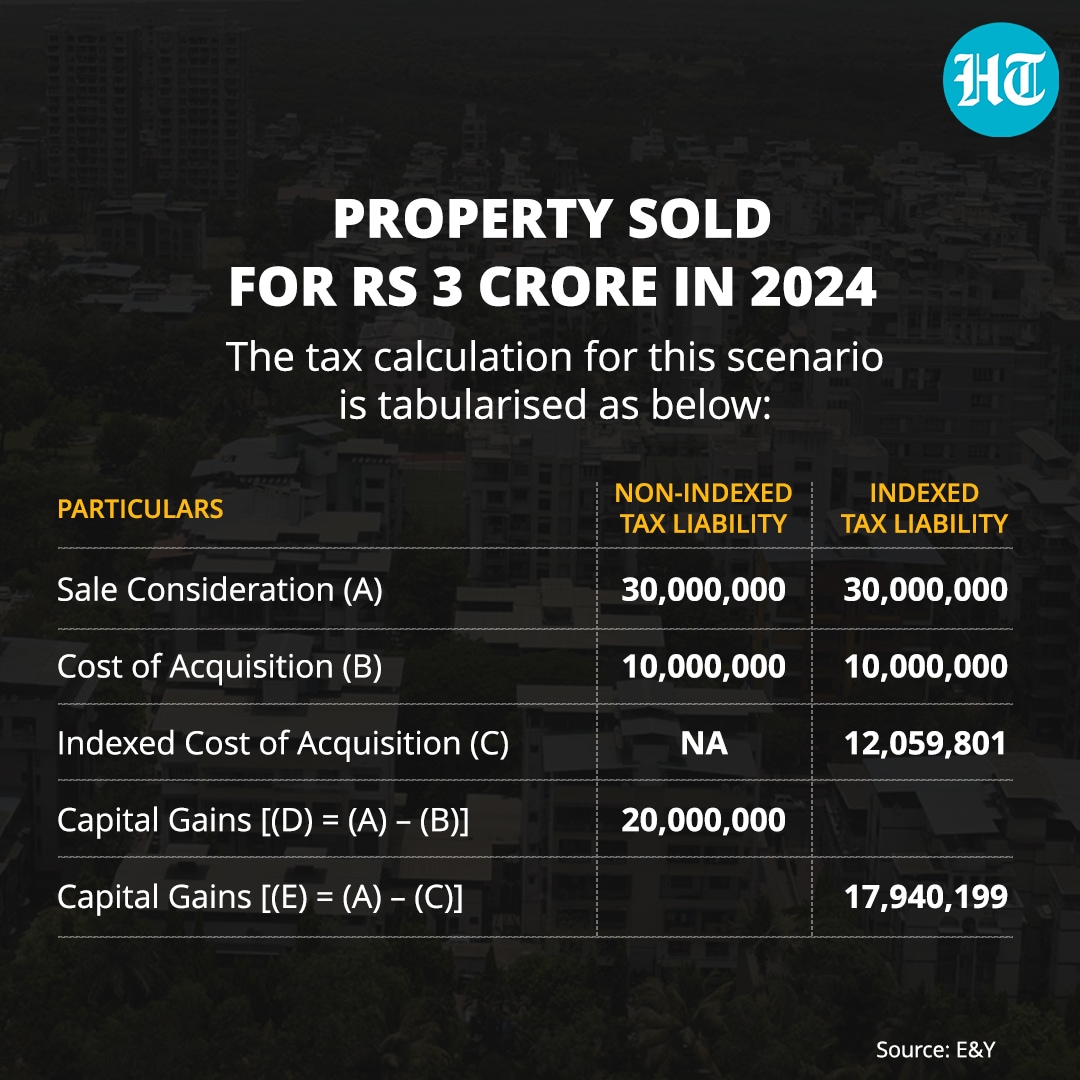

Considering two scenarios with sale price of Rs. 1.5 crore and ₹3 crore in 2024, the tax calculations are as follows:

Homeowners should remember that the choice between the indexed and non-indexed tax regime depends on the sale price. For a property sold at ₹1.5 crore, the indexed regime typically offers a lower tax liability, while for a sale at ₹3 crore, the non-indexed regime may be more advantageous. Homeowners must carefully assess the impact of indexation on their cost basis against the sale price to identify the tax regime that optimizes their tax outcome, explained Karnik.

3. How will removal of indexation impact property owners wanting to sell their asset after July 2024?

The removal of indexation will lead to higher taxable gains and increased tax liabilities for property owners, as they won’t be able to adjust the purchase price for inflation. Long-term property owners will be particularly affected, as the lack of indexation will not account for inflation over the years of ownership. However, for short-term holdings, the impact may be mitigated by the reduced tax rate option, said Karnik.

4. If a property is bought and is sold the same year, what will be the homeowner’s tax liability and which regime should he opt for?

In the scenario where a property is purchased and sold within the same year, the resulting gain is classified as short-term capital gain, for which indexation benefits are not applicable. Therefore, the homeowner will incur a tax liability based on the applicable slab rates for short-term capital gains, which do not take inflation into account, said Karnik.

5. Will a seller who wants to sell a property acquired in 2020 be impacted more than a seller who bought a property in 2010 or in 2024?

A seller who purchased property in 2010 stands to gain significantly from the indexed regime, as the inflation-adjusted purchase price over a decade lowers the taxable capital gain, allowing them to benefit from the 20% tax rate on a reduced gain.

In contrast, a seller who engages in both the purchase and sale of a property within the same year, such as in 2024, will face a different tax scenario. Since the transaction occurs within a single year, the gain is classified as short-term capital gains, and no inflation adjustment is applicable. Consequently, the seller will be taxed on the entire gain at their applicable income tax slab rates, which could be substantially higher than the long-term capital gains tax rate.

Sellers who purchased in 2020, the choice between the indexed and non-indexed tax regimes depends on the sale price. For a property sold at a lower price, the indexed regime may offer a lower tax liability, however for a sale of property at a higher price, the non-indexed regime may be more advantageous. Homeowners must carefully assess the impact of indexation on their cost basis against the sale price to identify the tax regime that optimizes their tax outcome, said Karnik.

6. How will people planning to sell their parental property inherited in or after July 2024 be impacted?

Individuals planning to sell property inherited in or after July 2024 can still avail the indexation benefits, as the inheritance of property does not constitute a transfer. For the purposes of calculating capital gains, the period of holding and the acquisition cost of the property are considered from the tenure and purchase price of the previous owner. This means that the beneficiaries can benefit from the reduced taxable gain due to indexation, which adjusts the cost basis for inflation from the time the original owner purchased the property up to the year of sale. Moreover, beneficiaries also have the option to choose the non-indexed regime, explained Karnik.

7. What should people who are planning to buy a second property for investment do now?

Individuals or Hindu Undivided Families planning to invest in a second property should consider the tax implications under both the indexed and non-indexed regimes. Section 54 of the Income Tax Act, 1961, permits the deduction of costs incurred in acquiring or constructing a new residential property from the capital gains of selling an existing residential house, providing a tax relief that encourages reinvestment.

When opting for the non-indexed regime, it’s crucial to remember that indexation benefits are forfeited, potentially leading to higher capital gains and necessitating additional investment in the new property to maximize the Section 54 deduction, with an investment ceiling of ₹10 crore, said Karnik.

Conversely, the Indexed Regime, despite its higher 20% tax rate, allows for an inflation-adjusted cost basis that can lower capital gains. Additionally, this reduction in capital gains not only lowers the tax liability but also means that if the seller is considering reinvesting in a new property, the amount required for reinvestment to claim tax exemption would be correspondingly lower, he said.

8. Several people channelise gains made in shares into real estate – what are the options available for them? Should they continue to invest in real estate?

For individuals and HUFs considering the transfer of gains from shares to real estate, they still have the options to avail tax benefits on capital gains tax on sale of non-residential assets (including shares) under Section 54F of the Income Tax Act, 1961.

However, if the taxpayer chooses to opt for a non-indexed regime, capital gains on such non-residential assets are likely to be higher, as the acquisition cost won’t be adjusted for inflation. This means that to fully utilize the tax deduction under Section 54F, which has an investment limit of ₹10 crore, a larger investment in residential property may be required compared to when indexation was available.

Investors should calculate the tax implications under both regimes and assess whether real estate investment still aligns with their financial goals, considering the increased capital gains and the tax benefits of reinvestment under Section 54F, Karnik added.

[ad_2]

Source link

Join The Discussion