[ad_1]

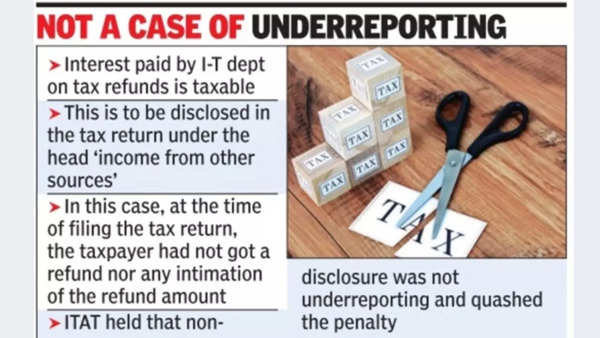

In their order, the ITAT bench comprising Amarjit Singh, accountant member, and Sandeep Singh Karhail, judicial member, emphasised that unless the refund is received, its interest element cannot be determined.Thus, non-disclosure in theI-T return cannot be considered as a case of ‘underreporting’ of income. In cases of underreporting of income as also misreporting, Section 270A of the I-T Act prescribes hefty penalties on errant taxpayers.

In this matter, K Singh, the taxpayer, filed her I-T return for the financial year 2016-17 and declared a taxable income of approximately Rs 1.9 crore. Her I-T return was selected for scrutiny assessment and her income was held to be ap proximately Rs 2 crore. The difference of Rs 9.7 lakh was the interest received on her income-tax refund, which she had not disclosed at the time of filing her I-T return.Under Section 244A of the I-T Act, the tax department needs to pay 0.5% interest of the refund amount per month or part of the month. This interest is taxable under the head ‘income from other sources’.

In Singh’s case, the I-T officer issued a show cause notice for imposition of penalty un der Section 270A. Singh responded that during the scrutiny assessment she had voluntarily offered the interest on her I-T refund, much before the notice was issued to her. Thus, it cannot be considered to be an act of ‘underreporting’ of income. Further, at the time of filing her I-T return, she neither had any intimidation of the refund amount nor had she received any refund by cheque or electronic bank transfer. As her submissions were not accepted by the lower tax authorities, she filed an appeal with the ITAT, which ruled in her favour.

Taxes being levied retrospectively: TS Singh Deo on online gaming after 52nd GST Council meeting

Ketan Ved, partner, Deloitte India, who represented the taxpayer in this matter, told TOI: “Tax refunds (including interest) can either be credited to the bank account of the taxpayer or can be adjusted against some earlier tax demands. The taxpayer may or may not be aware of the refunds adjusted till he or she receives an intimation. This decision of the ITAT, which called for deletion of the penalty, validates the position of the taxpayer that mismatches between the income offered to tax and what is ultimately taxed, cannot in genuine cases be considered as misreporting or underreporting of income, which can be penalised.”

“Taxpayers, who face similar challenges in their tax assessment, can explain their genuine circumstances with appropriate documentary evidence. They can rely on this ITAT order to defend against the levy of penalty,” Ved said.

[ad_2]

Source link

Join The Discussion